The dynamic backward shift methodology is used when the fallback rate is not available before the payment date as recommended by ISDA. This change is required to handle the IRS trades. It allows the client to derive a more accurate value when reporting risk or P&L.

Summit Offers Dynamic Backward Shift Functionality to Calculate Rates

The dynamic backward shift gives the option to business owners to calculate the rate using the rate averaging method, or the ISDA fallback method, which uses the Bloomberg rates to apply the rate on trades.

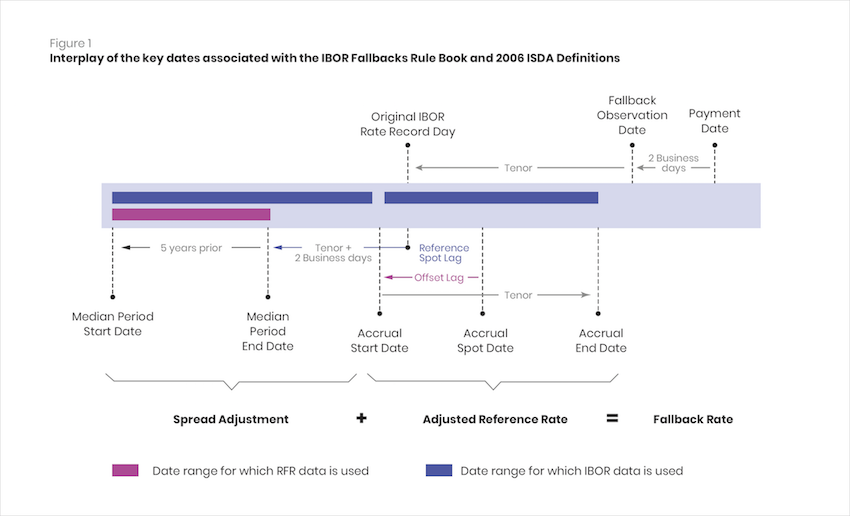

This function uses special logic to identify accrual start date, end date, and use that to calculate the average rate or the ISDA fallback rate provided by Bloomberg. ISDA has chosen Bloomberg Index Services Limited (‘BISL’) to calculate various IBOR fallbacks as the official adjustment services vendor.

This implementation gives users a choice to select whether Summit should use the rate calculated by observation period shift or the rate that is coming from Bloomberg. GreenPoint Summit, the Summit specialty services team at GreenPoint Financial, analyzed the purpose and parameters needed for the implementation of dynamic backward shift functionality in the client’s environment.

Purpose of The Utility

The purpose of the utility is to generate future fixing dates, which will be based on dynamic backward shift logic implementation in the latest versions of Finastra. The utility will generate fixing dates and store them in a new structure in Summit, overwrite the next fixing date on the dmASSET, and fix the rate on the trade with the rate from dmREFRATE (BBG rate stored) using a specific identifier. Several challenges were met by the team when inserting the parameters required for smooth working of the utility.

Parameters to be Inserted for The Utility

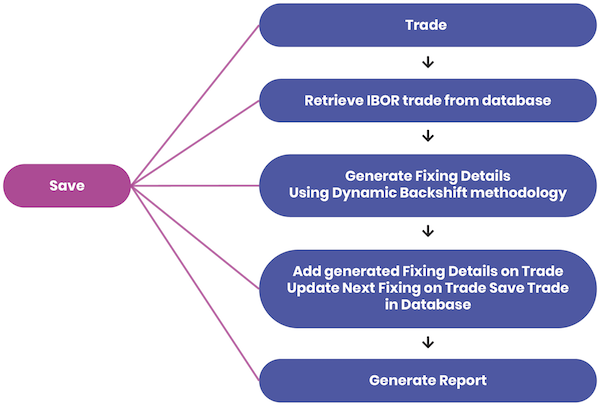

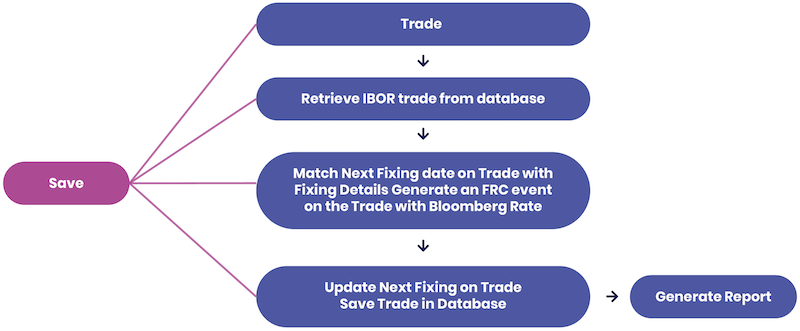

SAVE – using this option, the utility will perform the following functionalities:

- Generate fixing details for future periods

- Update the next fixing date with newly-calculated fixing detail

- Generated fixing details will be saved on the new structure on the trade

- Save the trade in the database.

RESET – using this option, the utility will perform the following functionalities:,

- Check the next fixing date on the trade with generated fixing details

- Generate an FRC event on the trade with the given Bloomberg rate

- Save the trade in the database.

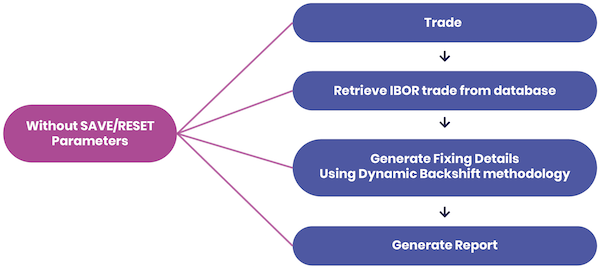

Without SAVE/RESET Parameters – Utility will perform the following functionalities:,

- Generate a report with fixing details

The Expected Output After Implementation

The utility will generate an output report based on the input parameters.

SAVE – Using this option, the report will contain fixing details generated by the utility.

RESET – Using this option, the report will contain the rate-fixing performed on trades.

After the implementation of the functionality, the workflow – SAVE and RESET was changed to meet the client’s requirements.

Changes in The Workflow with Dynamic Backward Shift Functionality

With the SAVE parameter, the client can:

With the RESET parameter, the client can:

Without the SAVE/RESET parameter, the client can: